Jarvis Exchange: Decentralize Your Financial Life

Even though the crypto industry is facing a bearish trend this year, and even if most ICOs fail to raise enough money to start their business while some of them just like to scam their investors, there are still a lot of blockchain innovations that are not yet fully realized. One of them is how to make our financial life get a lot easier. Jarvis is one of the projects that wanted to do that.

The Problems

- Blockchain has a big potential to solve a lot of problems in our status quo. But the road to achieving that is rocky and not yet reached even if there are more than thousands of cryptocurrency projects out there.

- One of the key problems why blockchain is hard to be adopted globally is because the power is hard to unlock by regular users who don't care about technical stuff that much. Even a slightest technical terms make them feel like they should avoid it. In return, they don't even take a deeper look at blockchain.

- Majority of developers doesn't build their platform using a user-centric approach. They just wanted to build the design that they think is the best one, but they forgot that new users aren't that familiar, and probably afraid to try new things. Not only that, user experience and user interface are most of the time being left behind. So, this 'newbie' have to use an entirely new app, that doesn't have a catchy look and poor user-friendliness.

- In the financial industry, there is a great inflexibility where users funds are difficult to move or used. They have to maintain each account on separate financial platforms such as banks, forex or others. And when they wanted to withdraw or send their funds, the fees are way too much. If there is an all-in-one platform where they can do any financial activities with just a simple click and sweep, they'll really enjoy it. Which is why Jarvis aims to be like that.

The Power of User-centric Approach

Before we dig deeper on how Jarvis works, it is important to remind and discuss a little bit about why the user-centric approach is important. I personally agree on what has been described on Jarvis whitepaper about the user-centric approach. There is a lot of company who got their success because they can design their product based on customer demands.

It doesn't matter how powerful or how great your apps is when you can't design them to fit your users' style or needs. Big companies such as Acorns or Revolut were able to acquire a large user base because they have a friendly UI, low fees, prioritizing over mobile strategy because most people use a mobile phone and design a user-centric onboarding process. In another word, the good user experience is a must to ensure massive adoption, regardless what kind of business that you run. The financial industry needs such a platform where a user can manage their financial problems in a matter of seconds. Jarvis aims to be the first one to do that by utilizing blockchain and cryptocurrency.

Applying Decentralized Technologies to Personal Finance

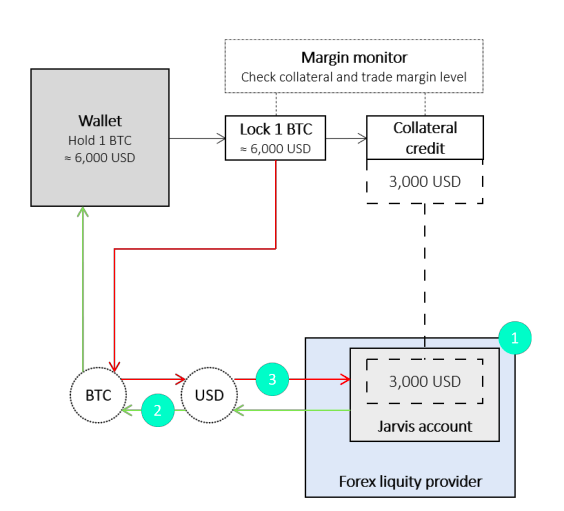

How margin trading happen with Jarvis

One of Jarvis purpose is to apply decentralized technologies to personal finance. In other words, they wanted to empower personal finance with blockchain, smart contracts, and cryptocurrency. There are several things that they wanted to do and aims to achieve when the platform is fully functional. Here are they:

- Improve user control over their own funds and financial activities such as trading and investment. They wanted to put more control and options for a user for their personal finance so that they don't have to register and pay or use a platform for each activity.

- Build a financial hub for every user using Jarvis framework, which includes:

a. Licensed centralized & semi-decentralized exchanges with multiple wallet structures and escrow functions.

b. An interoperable network of liquidity pools & protocols that enable instant cross-chain and cross-asset class exchanges. Basically, a liquidity pools that support cross-chain transfer between one blockchain to another, just like an atomic swap.

c. Features that allow users funds to be utilized as a medium of exchange, payment, collateral, contribute to liquidity pool.

d. Automation for exchanges, transfers, trading, loans, and payments.

e. Allow users to customize their own wallet as they wish. For example, set a new wallet for a loan, trading, and so on.

The Platform Architecture

The Backend Architecture

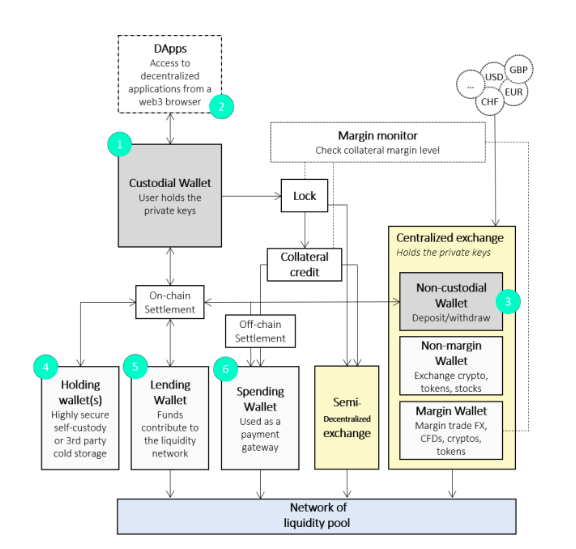

According to their whitepaper, their backend architecture is a centralized and semi-decentralized exchange leverages from a network of centralized and decentralized liquidity pools as well as escrow and collateralization type. To put it simply, on the backend, there will be a centralized and semi-decentralized exchange which connected to three types of funds source, liquidity pools, escrow and collateral funds. Each of them can be a decentralized type of funds (directly controlled by other parties) or centralized (on the Jarvis platform). Imagine it like a regular centralized or decentralized exchange where you fully control your funds or not.

By using this backend architecture, Jarvis aims to facilitate and automate a complicated process that happens behind the screen, such as the transfer of funds, exchange, trading activities, buying stock using Ethereum and so on. In other words, Jarvis will help users to access a lot of markets or investment assets directly, and they have a lot of options to participate in it. Either by directly buying them, contribute to the liquidity pools and so on.

The Frontend Architecture

A great backend doesn't equal to a great experience for users. In order to make it happens, we also need a great frontend. To put it simply, you have to design your apps beautifully and catchy, because this is the era where appearance is nearly everything.

Jarvis will build a simplified UI that doesn't require a lot of understanding about how the platform or the technical architecture behind it works. It will also develop an AI to help users do their job. In fact, a simple demo (or working AI) already exist. They use a conversational AI in order to record or receive bounty submission. It is a very simple demo, we should expect it will be much more powerful when the MVP launches.

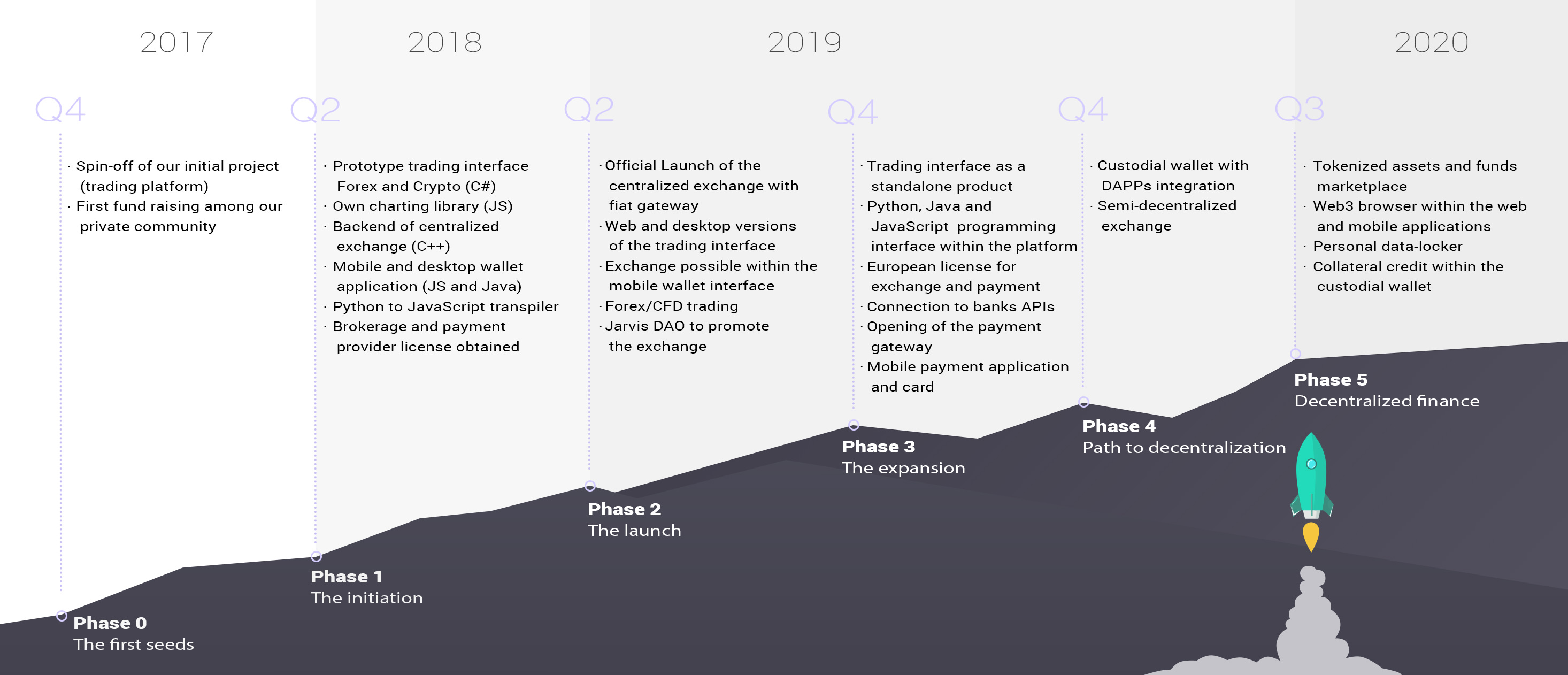

Jarvis Development Roadmap

The Exchange Architectures

A great exchange has an awesome infrastructure. In the case of Jarvis, they claim to have a combined centralized and decentralized exchange technologies to bring the fullest potential of a single, decentralized, all-in-one financial tools. Here's a recap of what they said on the whitepaper that you should read further.

Centralized Technologies

According to their whitepaper, centralized exchange technologies are used for several purposes. One of them is to facilitate fiat gateway and also making sure that it is compatible with existing regulations and financial systems. To put it in another word, these centralized technologies will help users to transfer, deposit or withdraw fiat money from exchanges with full compliance with existing regulations.

Some technologies include:

- A framework, matching engine and other components with scalable back-end infrastructure which allows every component to expand and provide more resources and have an autoload distribution mechanism. This means if there's a high load, the system would be able to sustain it by distributing the resources optimally.

- Provide distributed servers and decentralized load resource. Because of this, there won't be no single point of failure and when there is a broken server or load resource, another one can sustain it. Users can also choose to keep their data on their own devices only or to distribute it to the servers.

- A highly fast and powerful matching engine and messaging bus which claimed to be able to process more than 5 millions transactions per seconds. This is a big number and very bold claims, I'd personally love to see the MVP to test it.

- Multiple wallet structures. Every user has different kinds of wallets that serve a different purpose. These wallets include non-custodial, non-margin and margin wallet. Just as the name suggests, a non-custodial wallet is your fully controlled wallet, margin wallet is a wallet to store your funds to do margin trading and so on.

- Built-in escrow function for margin trading. Jarvis will build a wallet with full escrow function to serve several purposes, such as peer-to-peer trading, loan, margin trading and so on. It will help you to access and process loan deals quickly with full collateral support. It has several features, one of them is the ability to automatically sold collateralized assets when the users don't have enough funds to repay the loan.

Semi-decentralized Exchange Technologies

The other part of the exchange or Jarvis consists of several important semi-decentralized technologies. These technologies will be the back-end for semi-decentralized exchange activities from the user. Here are some of the key technologies:

A diagram of multiple wallet structure

- Multiple wallet structures. Just like in the centralized one, there will be multiple kinds of wallet that exist in the semi-decentralized exchange. One of them is a custodial wallet.

- Framework for collateral credit and margin trading. Even though you're using a decentralized exchange (or semi, as they said), you'll still be able to do credit and margin trading. It is quite interesting because then you don't have to go through KYC and so on to do margin trading, which is what you might be looking for.

- There will be on-chain settlement mechanism for your semi-decentralized activities. In other words, every transaction that you or any activities that you do will be possible to see on the blockchain. An off-chain settlement might be faster, but it lacks transparency. Unless you fully trust your partner, it makes more sense to use on-chain settlement.

- Cross-chain exchange, or to put it simply, the ability to trade coins or tokens from different blockchain directly from your wallet. You can imagine this like an Atomic Swap. It gives you the same flexibility with centralized exchange because you can trade different kinds of coins or tokens while maintaining privacy.

- Jarvis will also provide an audit of off-chain components that will be published on the blockchain. It sounds interesting, but several people might love to simply hide their activities and would rather avoid such audits. Well, I think your privacy won't be compromised as long as you do the basic stuff such as use one address only for every transaction.

Conclusion

To call Jarvis as an exchange doesn't sound right because Jarvis is not simply an exchange. It is an all-in-one financial platform for everyone who wants to deeply involved in their financial management. By combining centralized technologies and decentralized features, Jarvis might sound like a good choice to manage your funds without registering on multiple platforms. So this is the end of this article, but if you wanted to read more about Jarvis, you can do it by visiting these links below:

Jarvis Website:https://www.jarvis.exchange/

Jarvis Whitepaper:https://www.jarvis.exchange/jarvis_white_paper.pdf

Jarvis Facebook:https://www.facebook.com/jrvdg

Jarvis Twitter:https://twitter.com/Jarvis_Edge/

Jarvis Instagram:https://www.instagram.com/jarvis_io/

Jarvis LinkedIn:https://www.linkedin.com/company/jarvis-edge/

Jarvis Medium:https://medium.com/@jarvisedge

Jarvis Telegram:https://t.me/jarvisexchange

Jarvis Whitepaper:https://www.jarvis.exchange/jarvis_white_paper.pdf

Jarvis Facebook:https://www.facebook.com/jrvdg

Jarvis Twitter:https://twitter.com/Jarvis_Edge/

Jarvis Instagram:https://www.instagram.com/jarvis_io/

Jarvis LinkedIn:https://www.linkedin.com/company/jarvis-edge/

Jarvis Medium:https://medium.com/@jarvisedge

Jarvis Telegram:https://t.me/jarvisexchange

__________________________________________________________________________________

Bitcointalk username: perdimessi

Bitcointalk profile :

Eth address :0x19C8eB6d14C17E2918aF2D0Bf03F649F05606598

Komentar

Posting Komentar