Credito - Distributed Credit Information Network for Blockchain

Hello everyone, in this article, I will explain about credit.

Introduction

Credito improves transparency and reliability as a distributed credit information network that provides Ethereum blockchain, smart contracts and IPFS to provide credit scores, transaction ratings and loan markets.

Credito provides financial support for “invisible credit” by providing accurate and reliable credit scores. A relatively high percentage of young people do not see credit or scores. It is not surprising that there is not much time to establish a credit history. However, in some cases, if you don't become a credit for young adults, you can be the lifeblood of credit transparency. People who don't have a credit score or have no credit history may find it harder to rent a house, buy a car, buy a house, or get a credit card. In short, it blocks many common financial transactions.

Credito enables the industry to make informed decisions by establishing a credit intelligence network for the credit industry to determine when fraudulent transactions occur and prevent credit risk. Financial institutions are generally referred to as one of the most regulated industries, but are still the subject of fraud. The consequences of fraud are not important, causing financial difficulties for banks and customers. Financial institutions are actively committed to detecting fraud and reducing the cost of fraud, but they still lack real global intelligence about all known fraud and compromise.

Credito is introducing a decentralized mortgage market that allows lenders and borrowers to connect anywhere in the world. This eliminates physical constraints and reduces existing loan and management costs, creating a better credit market than the current one.

Problem Credito

Despite the efforts of banks, card issuers and merchants, credit card fraud has grown much faster than credit card spending. Data leakage undermines the details of the card, and the increase in online shopping has also increased the chances of e-commerce fraud.

According to Nielsen's 2016 report, credit card fraud losses in 2015 were $21.8 billion, an increase of 162% from $8 billion in 2010. The loss in 2016 has exceeded $24 billion and is expected to reach $31 billion by 2020.

1 monopoly

Global credit information, and a small number of controls through the Credit Score Model Bureau is outdated, depending on the country or region, there is a flaw that it has thought you have not carried many times. “More than one-third of the five people have obtained a potentially significant error in the credit file. “It seems more dangerous for consumer products to file 8 million complaints a year, by contacting the three major credit reporting agencies. "

2 security

Equifax recent hacker attacks to hackers exposed more than 140 million unique identity and personal information, known as the worst in US history of security vulnerabilities.

In 2016, there are over 15 million victims of identity theft or fraud The total stolen value is $160 billion.

3

The data collected by central information agencies is centrally managed. It is a common misunderstanding that these countries automatically exchange incorrect information. These institutions are independent companies that provide similar service charges. .

4 portable

portable credit score may have access to credit in the absence of credit borrowers are falling, so international, from the outset, we need to re-establish their credit was denied.

5 when the information becomes more concentrated, old Analysis and incomplete information become more monopolistic and incomplete. This leads to decisions that are made without all available information, which greatly increases the associated risks. In addition, credit scores are not updated in real time, current credit history Not reflected in the decision-making process, which hinders the ability to bypass millions of consumers and businesses

Solution Credit

I have created Credito Network or Credito to solve the above problem. Distributed Network (Star File System) IPFS Credit Bank provides credit information and distributes the loan market as based on the revenge blockchain with smart contracts who are combined with Fiat and digital resources, loan experts underdeveloped or youth credit structures that encourage the credit industry The expansion and proficiency of operations allow credit to be extended to facilities. The ecosystem provides a solution that allows authenticated lenders to securely and reliably issue credit to verified borrowers.

Decentralization provides more security and trust. This is a way to organize everything in a way that does not require trust from third parties. Eliminate trust by running code that does not require centralized management, management, or servers. By distributing loans, we do not require banks or other brokers to make loan transactions.

Decentralization through the use of smart contracts also eliminates the trust requirement between borrowers and lenders, providing a transparent loan environment that is unreliable and unavailable in today's marketplace.

Smart contracts achieve this through predefined parameters, eliminating trust between participants. They are also completely transparent and can be seen by anyone using the Ethereum block browser.

I have created Credito Network or Credito to solve the above problem. Distributed Network (Star File System) IPFS Credit Bank provides credit information and distributes the loan market as based on the revenge blockchain with smart contracts who are combined with Fiat and digital resources, loan experts underdeveloped or youth credit structures that encourage the credit industry The expansion and proficiency of operations allow credit to be extended to facilities. The ecosystem provides a solution that allows authenticated lenders to securely and reliably issue credit to verified borrowers.

Decentralization provides more security and trust. This is a way to organize everything in a way that does not require trust from third parties. Eliminate trust by running code that does not require centralized management, management, or servers. By distributing loans, we do not require banks or other brokers to make loan transactions.

Decentralization through the use of smart contracts also eliminates the trust requirement between borrowers and lenders, providing a transparent loan environment that is unreliable and unavailable in today's marketplace.

Smart contracts achieve this through predefined parameters, eliminating trust between participants. They are also completely transparent and can be seen by anyone using the Ethereum block browser.

1 Credito is transparent.

Today, when you trade through the banking system, you can't get books. The Ethereum network provides a constant ledger, all transactions are recorded and always open for inspection. All transactions deployed in the Ethereum blockchain can be navigated through the block navigator. Transparent ledgers often eliminate the trust required to trade between two financial institutions. In a banking system, the calling party must trust the recipient and vice versa. A payment receipt is required to confirm the payment. However, such receipts do not prevent forgery or forgery. Therefore, we are not sure whether the other party has received a transaction that may lead to friction and uncertainty. Credito uses the transparency provided by the supervisor to oversee the activities of borrowers and lenders so that neither party exaggerates itself. For example, it is used to prevent borrowers from getting multiple loans from other lenders.

2 A credit loan agreement is a wise contract.

The Credito Loan Agreement is an auto-executed contract that is written directly to the line of code based on the terms of the agreement between the lender and the borrower, thereby increasing transparency and reliability. The code and contracts contained here are distributed throughout the distributed chain of distributed chained networks. The “credit loan agreement” allows trust transactions and contracts to be executed between heterogeneous and anonymous parties without the need for a central authority, legal system or external force mechanism. Transactions are traceable, transparent and irreversible.

3 Credito is “no trust”.

Credito avoids the risks associated with third parties and eliminates the need for mutual trust. When the borrower makes a loan application to Credito Network, once the loan is placed, the counterparty cannot manipulate or stop the loan request. To avoid unfair and unwelcome behavior, it is important to eliminate the risk of the other party or a third party.

Today, when you trade through the banking system, you can't get books. The Ethereum network provides a constant ledger, all transactions are recorded and always open for inspection. All transactions deployed in the Ethereum blockchain can be navigated through the block navigator. Transparent ledgers often eliminate the trust required to trade between two financial institutions. In a banking system, the calling party must trust the recipient and vice versa. A payment receipt is required to confirm the payment. However, such receipts do not prevent forgery or forgery. Therefore, we are not sure whether the other party has received a transaction that may lead to friction and uncertainty. Credito uses the transparency provided by the supervisor to oversee the activities of borrowers and lenders so that neither party exaggerates itself. For example, it is used to prevent borrowers from getting multiple loans from other lenders.

2 A credit loan agreement is a wise contract.

The Credito Loan Agreement is an auto-executed contract that is written directly to the line of code based on the terms of the agreement between the lender and the borrower, thereby increasing transparency and reliability. The code and contracts contained here are distributed throughout the distributed chain of distributed chained networks. The “credit loan agreement” allows trust transactions and contracts to be executed between heterogeneous and anonymous parties without the need for a central authority, legal system or external force mechanism. Transactions are traceable, transparent and irreversible.

3 Credito is “no trust”.

Credito avoids the risks associated with third parties and eliminates the need for mutual trust. When the borrower makes a loan application to Credito Network, once the loan is placed, the counterparty cannot manipulate or stop the loan request. To avoid unfair and unwelcome behavior, it is important to eliminate the risk of the other party or a third party.

Points - Credito Network Token

Credit is an ERC20 token used by Credito as a currency, governance mechanism and reward system. Credito can set the price and charge the service fee as a credit card.

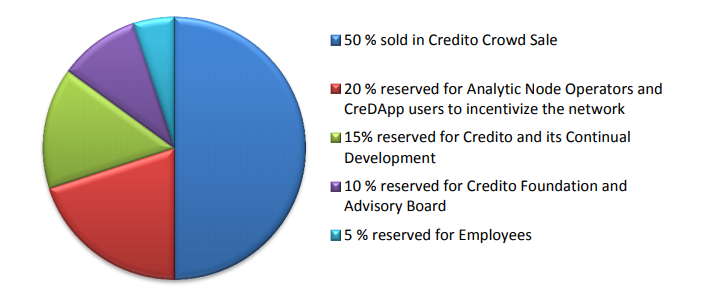

Token Assignment

For further development, Credito will conduct a one-time token generation event ("TGE") and mass sales, publicly selling 50% of the token. TGE's start date will be announced shortly, and a total of 1 billion credits will be allocated as follows:

Credit is an ERC20 token used by Credito as a currency, governance mechanism and reward system. Credito can set the price and charge the service fee as a credit card.

Token Assignment

For further development, Credito will conduct a one-time token generation event ("TGE") and mass sales, publicly selling 50% of the token. TGE's start date will be announced shortly, and a total of 1 billion credits will be allocated as follows:

1 Employees are assigned a vesting period of 12 months, 25% per quarter, for a six-month cliff. On the token trading date, the dividend is proportional to the term of each employee.

2 The Credito Foundation's mission is vested for 12 months.

2 The Credito Foundation's mission is vested for 12 months.

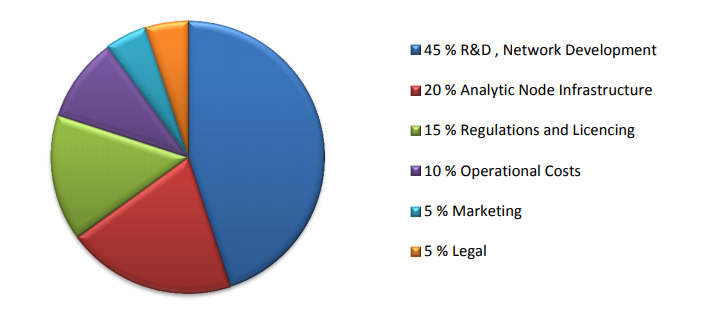

Planned Use of Funds

Roadmap

Credito will be developed in six steps to achieve important milestones at each stage.

Stage1 is complete.

1 Concepts and research.

2 Credito Incorporation.

3 White papers.

4 proof of concept - high speed transaction scoring system.

5 Start the website.

Roadmap

Credito will be developed in six steps to achieve important milestones at each stage.

Stage1 is complete.

1 Concepts and research.

2 Credito Incorporation.

3 White papers.

4 proof of concept - high speed transaction scoring system.

5 Start the website.

Step 2 User registration, verification and cooperation

1 CreDApp front-end development

2 user registration

3 automatic ID verification

4 cooperation with financial institutions

2 user registration

3 automatic ID verification

4 cooperation with financial institutions

Three-stage infrastructure and intellectual development

1 External API development.

2 Analyze the node infrastructure

3 Develop the Credito scoring engine.

4 Credit score generation.

5 Trading point modeling.

2 Analyze the node infrastructure

3 Develop the Credito scoring engine.

4 Credit score generation.

5 Trading point modeling.

Step 4 Develop and deploy a smart contract

1 Scoring and leasing smart contract development.

2 Smart contract auditing.

3 Integrate smart contracts with the Credito Analytic Engine and node infrastructure.

4 Run on the test web.

5 Test the web trial version to provide partners with real-time ratings.

2 Smart contract auditing.

3 Integrate smart contracts with the Credito Analytic Engine and node infrastructure.

4 Run on the test web.

5 Test the web trial version to provide partners with real-time ratings.

Step 5 begins

1 main net release.

2 Fully decentralized credit information is provided to partners.

3 Operators participating in the network of external analysis nodes.

4 Marketing and New Partnership

2 Fully decentralized credit information is provided to partners.

3 Operators participating in the network of external analysis nodes.

4 Marketing and New Partnership

6-step end-to-end loan agreement on the main network

1 CreDApp and Mobile App Development

2 Credito Smart Credit Agreement Development and Audit

3 Credit Backend

4 Test Network and Caredepp Main Level by Integrating Smart Credit Agreement

2 Credito Smart Credit Agreement Development and Audit

3 Credit Backend

4 Test Network and Caredepp Main Level by Integrating Smart Credit Agreement

Team

Founding team:

Founding team:

1 Govindarajula Sikar

Srikar has its own professional skills, technical enthusiasts support ardent believers and blocking chains, decentralization must show creativity and entrepreneurship. He designed and developed several high-speed transaction processing engines and scoring engines for low latency systems. Over 10 years of experience in providing state-of-the-art technology products in the areas of finance, data communications, medical and embedded systems.

2 Narendra Allam

Naren is a technical expert. He founded the Bang Music Factory, which publishes the music production process through a secure mobile app that standardizes, enhances and globalizes the music production process. He is a member of the internal trading system architecture team responsible for code quality compliance for Bank of America. We have extensive experience in building algorithms in a variety of fields, including finance and banking, blockchaining, and passion for networking and distributed technologies. Naren has extensive experience as an expert in C, C++, Python, and Microsoft, Cisco, Bank of America, Credito, and more.

3 Harada is an

entrepreneur, data scientist, financial technology expert and veteran of UangTeman.com. He founded PH Technologies. He holds a master's degree in mechanical engineering from the Indian Institute of Technology and has an international publication on machine learning on the best paper cars. His professional research experience covers the Defense Research and Development Agency's statistical analysis team and services in areas such as cryptanalysis, operating systems, storage and virtualization. Recently he was in the identification system to assess the credit risk in the banking sector, especially the unsecured lending sector, to evaluate and conduct extensive research to determine the proxy variables that are consistent with traditional banking and to exceed the credit risk through establishing credit risk algorithms. Benefits and construction. Big data analysis on the data science platform.

Srikar has its own professional skills, technical enthusiasts support ardent believers and blocking chains, decentralization must show creativity and entrepreneurship. He designed and developed several high-speed transaction processing engines and scoring engines for low latency systems. Over 10 years of experience in providing state-of-the-art technology products in the areas of finance, data communications, medical and embedded systems.

2 Narendra Allam

Naren is a technical expert. He founded the Bang Music Factory, which publishes the music production process through a secure mobile app that standardizes, enhances and globalizes the music production process. He is a member of the internal trading system architecture team responsible for code quality compliance for Bank of America. We have extensive experience in building algorithms in a variety of fields, including finance and banking, blockchaining, and passion for networking and distributed technologies. Naren has extensive experience as an expert in C, C++, Python, and Microsoft, Cisco, Bank of America, Credito, and more.

3 Harada is an

entrepreneur, data scientist, financial technology expert and veteran of UangTeman.com. He founded PH Technologies. He holds a master's degree in mechanical engineering from the Indian Institute of Technology and has an international publication on machine learning on the best paper cars. His professional research experience covers the Defense Research and Development Agency's statistical analysis team and services in areas such as cryptanalysis, operating systems, storage and virtualization. Recently he was in the identification system to assess the credit risk in the banking sector, especially the unsecured lending sector, to evaluate and conduct extensive research to determine the proxy variables that are consistent with traditional banking and to exceed the credit risk through establishing credit risk algorithms. Benefits and construction. Big data analysis on the data science platform.

Advisory Board:

1 Dell Hawkinsdale

has extensive experience in strategic planning. He is the executive manager of the Federal Bank Group consultant. He led a national project at the National Bank of Australia. Dale works with two of Australia's four largest banks to provide Credito with extensive banking, finance and strategic knowledge.

1 Dell Hawkinsdale

has extensive experience in strategic planning. He is the executive manager of the Federal Bank Group consultant. He led a national project at the National Bank of Australia. Dale works with two of Australia's four largest banks to provide Credito with extensive banking, finance and strategic knowledge.

To learn more about Credito, please visit the following links:

1 Website: https://credito.io/

1 Website: https://credito.io/

2 White paper: https://credito.io/pdf/whitepaper.pdf

3 Note: https : //bitcointalk.org/index.php?topic=2483679.0

4 Facebook: https://www.facebook.com/CreditoNetwork

5 Twitter: https://twitter.com/CreditoNetwork

6 LinkedIn: https://www.linkedin.com/company/credit-network

Author

Bitcointalk user name : Perdimessi

Bitcointalk profile :

Eth address :

0x19C8eB6d14C17E2918aF2D0Bf03F649F05606598

Komentar

Posting Komentar